Resources

Student Loans

Student loans

Many young adults planning to attend college will have to use student loans to help pay for their education. Without a complete understanding of the borrowing process and the specific loan terms, students can find themselves overwhelmed with student loan debt for years after they’ve completed their education. So it is important to make informed choices when borrowing money for school.

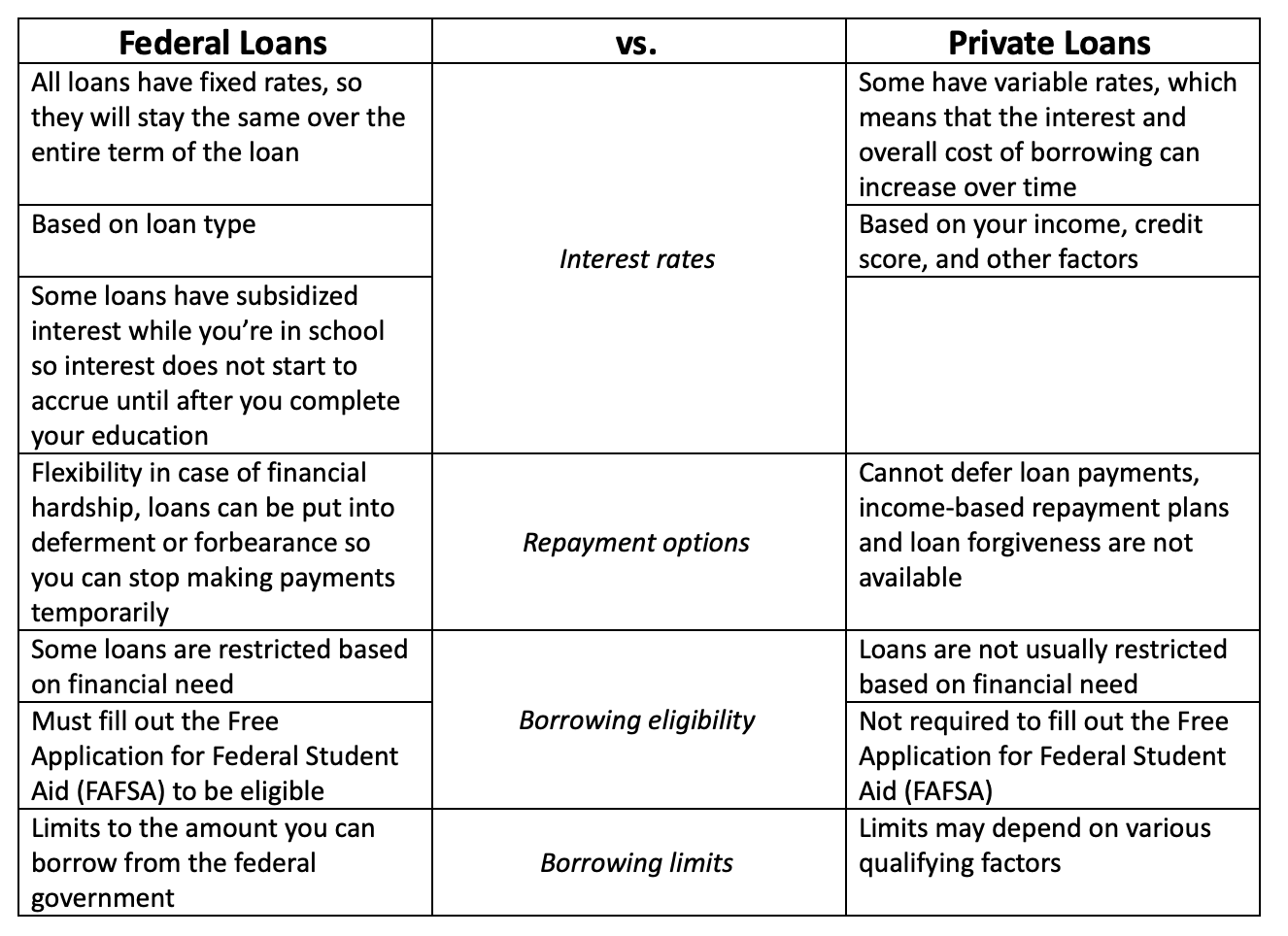

Compare the advantages and disadvantages of federal loans versus private loans:

Federal student loans generally have more advantages over private loans. However, there are some significant limitations, and sometimes private loans are also needed to finance your education. If you have exhausted your options for federal loans and need a private student loan as well, you should compare options from multiple lenders and ask some important questions of each:

- What are the eligibility requirements for the loan? Do I qualify?

- What are the interest rates? Are they fixed or variable?

- How long will it take to repay this loan?

- Are there any loan application or origination fees?

- Source: Everything You Need to Know About College Loans. Christy Rakoczy, Student Loan Hero.

Additional Student Loan Resources

Education can be a major investment. Before borrowing large amounts of money for school, make sure you know what you’re getting yourself into.

Here are some additional resources to explore, click the links below: